Updated Nov. 4, 2024

In the past five years, homeowner equity has spiked 63%. That’s great news for homeowners, but if you’re part of the increasingly large proportion of homeowners who are house-rich, cash poor, that equity is most likely out of reach.

A home equity agreement (HEA), also known as a shared equity agreement or HEA loan, is a way for homeowners like you to access the equity in their homes without resorting to traditional methods such as loans or lines of credit. This makes it an attractive option, particularly if you have low credit, or no income or limited income.

Here, we’ll dive into what home equity agreements are, how they work, and what risks you should be aware of if you’re looking into a home equity agreement. Let’s get right to it!

What Is an HEA Loan?

An HEA loan, or home equity agreement, is a way to get cash in exchange for a share of your home’s future value. This can be a little confusing, so let’s break it down another way.

With a home equity agreement, you essentially sell a share of your home to an investor, just like a business might sell stocks or a part of its ownership. To spell that out, an investor is giving a business money now and in turn getting a share of ownership because they believe the business—and by extension their share of ownership—will be worth more in the future.

Ending a home equity agreement also parallels the business world. If a business took investments and sold parts of its ownership, it would have to pay those investors back to regain total ownership. And if the company had been doing well, the investor’s share of ownership could increase in value.

With a home equity agreement loan, you won’t just need to pay back the initial investment the HEA loan company made in your home, you’ll need to pay it back along with the appreciation in your home’s value in that time.

HEA Loan Example

Assume your home’s value is $500,000 at the agreement’s start, and you receive 10% equity from the HEA company—$50,000.

Then, assume your home appreciates along national averages at about 3% per year.

This means that after 10 years, your home would be worth approximately $671,958.

If your agreement says that the HEA company receives 25% of that appreciation, they’d be earning $42,989 of the $171,958 total appreciation.

So, to retake full ownership of your home, you’d need to repay the initial $50,000 equity payment, plus the $42,989 in equity, for a total of $92,989.

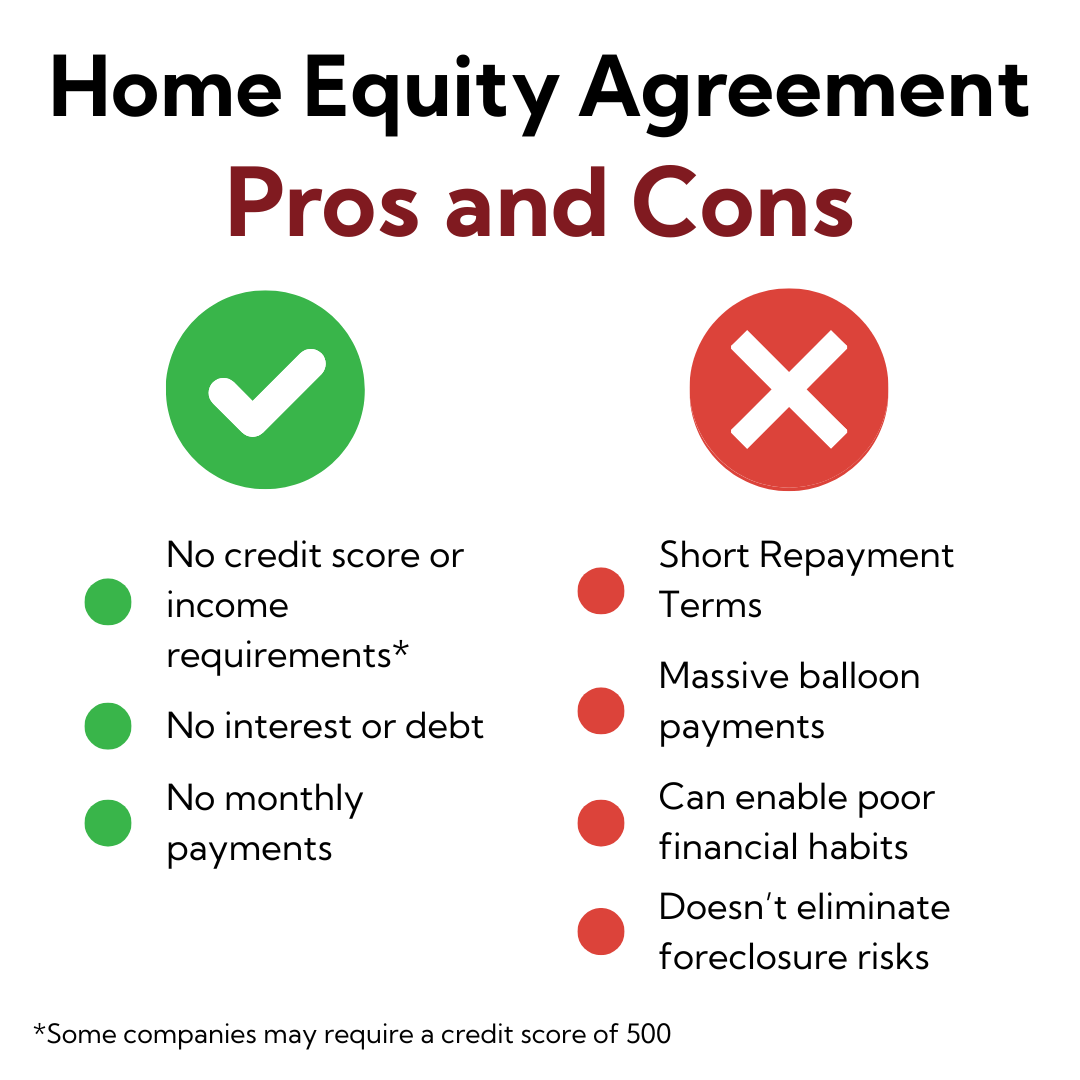

Home Equity Agreement Pros and Cons

Like any financial decision, pursuing a HEA shouldn’t be taken lightly, as it can significantly affect your future. While they may be a viable option, they may not always be the best option. So let’s weigh the pros and cons of home equity agreements:

Advantages of HEA Loans

If you’re facing burdensome debt, medical bills, job loss, or any other financial challenge, you might have struggled to find help through traditional banks or lenders. Home equity agreements offer a welcome change from those borrowing options. Some of the key advantages of home equity agreements include:

1. No Credit Score Or Income Requirements*

Compared to traditional financing options like a HELOC or home equity loan, eligibility for home equity agreement isn’t based on your credit score or income. Home equity agreements open opportunities for homeowners who are facing financial challenges and wouldn’t be eligible for financing from traditional banking institutions and lenders.

For example, a homeowner who lost their job wouldn’t qualify for a home equity loan because they don’t have an income. With a home equity agreement, they may be able to access some of their home equity despite that.

*May vary by provider.

2. No Interest Or Debt

According to Experian, one of the U.S.’ main credit reference agencies, the average consumer held over $23,000 in debt in 2023. And that’s not even including mortgages. So, it’s no surprise that homeowners across the country are hesitant to add even more debt to that balance.

Home equity agreements help homeowners in this situation because they aren’t a form of debt. Plus, because there aren’t any interest payments, homeowners can use their home equity to address their most pressing financial needs without the constant burden of compounding interest.

3. No Monthly Payments

For homeowners who are at risk of falling behind on their mortgage or other loan payments, home equity agreements offer a respite. With no monthly payments, home equity agreements allow homeowners to focus their resources on paying off debts, eliminating medical bills, or making improvements to their home.

Risks of Home Equity Agreements

While home equity agreements have distinct advantages when compared to traditional lending options, they’re not risk free. Let’s take a look at some of the risks that have to be taken into consideration when looking into a home equity agreement.

1. Comparatively Short Repayment Terms

Most HEA loans have a 10 year term. Compared to a mortgage, that doesn’t leave you with much time to pay back your agreement. This dovetails perfectly with risk #2, which is the threat of balloon payments.

2. Balloon Payments Could Force You Out Of Your Home

Most home equity agreements require a lump sum payment at the end of the contract. This can be as much as $60,000 depending on the value of your home and its appreciation. Although you won’t face monthly payments during the agreement, balloon payments are extremely difficult to cover without a loan.

3. Home Equity Agreements Can Enable Unimproved Financial Habits

If you’re using a home equity agreement to pay off debt, it’s essential to consider the habits or circumstances that put you in debt originally. For example, if you’re using the funds from your home equity agreement to pay off credit card debt, you should ensure you’ve changed your spending habits.

If you haven’t changed the way you manage your finances, the funds from a home equity agreement could be a risky temptation. Misusing those funds could make your situation even worse.

4. Hea Loans Don’t Eliminate Foreclosure Risks

For the vast majority of people who use home equity agreements, they are a short-term solution. HEA loans work best when you plan to sell your home before the term’s end, or get a loan to cover the balloon payment at the term’s end. However, if you can’t get approved for the loan, you may be forced to sell or face foreclosure.

Related Read

HEA Loan Requirements

Your Current Home Equity

Most HEA loan providers require that you have between 20-40% equity in your home. This is slightly higher than traditional forms of financing like home equity loans, but home equity agreements are more lenient than HELOCs in other ways.

Lien Type and Existing Secured Financing

If you have other loans secured to your home, you may not qualify for an HEA loan. This is because the home equity agreement company would struggle to recover their investment if your home is foreclosed upon by another bank.

While this is generally non-negotiable, some home equity agreement companies will make exceptions if you’re intending to use your home equity to consolidate and eliminate those existing debts that would take priority over the HEA loan.

Your Debt-to-Income Ratio

Your debt-to-income ratio quantifies how much of your monthly income is going to existing debts. Just like with HELOCs and home equity loans, most home equity agreement companies prefer a debt-to-income ratio of 40% or less, meaning that no more of 40% of your monthly income is going to service other debts

Related Read

Your Credit Score

Finally, your credit score plays a huge role in most other types of borrowing, but it’s not as important for HEA loans. This is because the main factors HEA loan companies are concerned with have to do with your home’s value, not your ability to make monthly payments.

Because of this, some home equity agreement providers have no credit score requirement at all.

HEA vs. HELOC: Which Should You Use?

Home equity agreements (HEAs) and home equity lines of credit (HELOCs) are distinctly different, both having unique advantages, disadvantages, and qualification criteria. Let’s take a closer look at those differences here.

Differences Between Home Equity Agreements and HELOCs

- Different structures: HEAs are not actually loans; they’re shared equity agreements. You receive a lump sum of cash in exchange for giving the HEA company a stake in the future appreciation of your home’s value. Meanwhile, HELOCs are a traditional loan that uses your home as collateral. You borrow a lump sum, which you repay over time with fixed monthly payments.

- Payment types: With HEAs, no monthly payments are required because the HEA company’s return depends on your home’s value at the end of the agreement term. Conversely, monthly payments are mandatory throughout a HELOC’s term.

- Repayment terms: With HEAs, repayment is based on the future value of your property, so if your property appreciates, the HEA provider receives a percentage of the appreciation in addition to the original amount given, as outlined above. On the other hand, with a HELOC, you repay the fixed loan amount plus interest over the loan term, regardless of any changes in the home’s value.

- Eligibility: With a home equity agreement, your credit score is less important because there are no monthly payments. Approval focuses more on your home’s value, equity, and location. By comparison, your credit score, income, and debt-to-income (DTI) ratio are crucial factors for HELOCs because you need to demonstrate your ability to make monthly payments.

- Key risks: Because the HEA provider shares in your home’s appreciation, you may give up a substantial portion of your future home equity gains, and even face balloon payments that force you to sell your home. With a HELOC, the line of credit’s fixed monthly payments add to your existing financial obligations, which could be a strain if your income or expenses fluctuate.

- Ideal use: Home equity agreements are ideal if you want to access your equity without adding a monthly payment. It’s also a better choice if you have a poor credit score or an inconsistent income. HELOCs are better if you can afford monthly payments and want to keep your equity gains under your control.

The Bottom Line: Is a Home Equity Agreement a Good Idea?

Is a home equity agreement a good idea? As with most financial decisions, there’s no clear-cut answer for whether a HEA loan is a good idea. It ultimately depends on your financial circumstances.

As we summarized above in our comparison of HEAs against HELOCs, home equity agreements make a lot of sense if you don’t want a monthly payment, don’t have the greatest credit profile, or don’t have a consistent income. However, for all their benefits, HEA loans aren’t without risk. You should weigh the advantages against your ability to handle the balloon payment and your willingness to sell your home.

Ultimately, it’s not a decision you should rush. Take the time to consider your options for financing and choose what you’re confident you can handle.

Not comfortable with a home equity agreement? Try SKYDAN’s sale-leaseback solution

A home equity agreement is a ray of hope for many homeowners. But the ideal scenario it offers can disguise the risks. If you’re not comfortable with the potential of being burdened by your home’s appreciation or facing an enormous balloon payment, consider SKYDAN’s sale-leaseback program. It offers the same benefits without the risk of long-term costs.

Like a home equity agreement, SKYDAN doesn’t care about your credit score, income, or debt. As long as you have equity in your home, you could qualify for our program. Here’s how it works:

Ready to take the next step toward financial freedom? See if you qualify today!